The Higgs government, as part of its 2021-22 provincial budget released this week, announced its plans for how carbon pricing revenue will be spent in the year ahead. Earlier in the week, the province issued a summary of how it used the funds last year. The bottom line for both: carbon pricing revenue is not being spent to help citizens lower their energy use, make their homes more comfortable and energy efficient, or adapt to a world increasingly moving toward decarbonization.

We’ll get into the nuts and bolts of how the Higgs government is failing to use carbon pricing revenue for the benefits of citizens below. First, let’s talk about how it should be spent to help citizens, families and small businesses.

All revenue from the carbon tax should flow to the Climate Action Fund to improve existing programs and create new initiatives, incentives and rebates that help New Brunswickers shift away from fossil fuels.

Our neighhours in Nova Scotia are benefiting from a government that is taking climate change and support for citizens much more seriously. Options for New Brunswick that mirror this approach include:

- Commit to a new renewable energy standard, with 80 per cent of New Brunswick’s power coming from renewables by 2030; provide incentives to help make it happen.

- Significantly increase our commitment to low-income energy-efficiency retrofits with a focus on ‘deep retrofits.’ A deep retrofit improves a home’s EnerGuide rating by 50 per cent or more. Currently, retrofits are achieving shallow improvements. Increase the province’s contribution to NB Power’s Low-Income Retrofit program so larger grants are allocated to deep retrofits of low-income households.

- Increase investment in deep retrofits of households and buildings owned by small businesses, including getting off oil. Focus on achieving at least a 50 per cent improvement in the EnerGuide rating. The federal government has committed to offering up to $5,000 to retrofit 700,000 homes across the country. If the Higgs government and NB Power matched this incentive, up to $10,000 could be available for the deepest retrofits. The province could also consider creating a pool of funds to offer low-interest loans that include a forgivable portion scaled to deep retrofits.

- Use existing federal programming to deliver electric vehicles (EVs), plug-in hybrids and e-bike incentives through dealerships to put 20,000 EVs on the road over the next 10 years. We could match Nova Scotia’s $3,000/vehicle. Combined with the federal grants of up to $5,000 per vehicle, $8,000 could help get less polluting vehicles on the road. Dealerships currently handle all the paperwork for consumers under the federal program; we can deliver New Brunswick’s incentive the same way.

- Target provincial fleets for EV conversion: government (municipal and provincial, transit), as well as taxis and delivery vehicles to reach 200 electric vehicles per year.

- On the infrastructure front, introduce household-focused programming to help citizens deal with extreme weather events related to climate change, such as flooding. In our province, only Moncton offers incentives for homeowners to install backflow valves in basements to prevent sewer backups and make communities more resilient to floods.

- Invest in implementing all community adaptation plans.

That’s how the Higgs government should be using carbon pricing revenue to benefit citizens and small businesses in the fight against climate change. Now let’s look at how they spent last year’s revenue, and how they plan to use revenue from 2021-22.

To understand the Higgs government’s approach, we need to recall differences in how the federal and provincial carbon-pricing systems work. The federal carbon levy program includes a price on fossil fuels and activities generating greenhouse gases. Industry operates under a different and much weaker system than citizens do even under the federal system. In New Brunswick, it is even worse. This article, however, does not focus on industry; it focuses on how carbon pricing affects citizens.

A levy/rebate system like N.B. is currently using becomes a tax grab

Under the federal carbon levy system, we pay to pollute primarily through the gasoline we consume or natural gas we use to heat buildings. The federal system then rebates households so that, on average, households receive more tax rebate than is paid in the carbon levy. Unfortunately, there is no guarantee that people spend their carbon-pricing tax rebate to reduce greenhouse gas-emitting activities or improve their home’s energy usage, such as through energy efficiency upgrades, or installing heat pumps or solar panels.

In New Brunswick, with approval of the federal government, the carbon levy so far operates more like a tax, with no rebates. Last year, New Brunswick applied the federal carbon levy amount of 6.6 cents a litre to fuels like gasoline. Then, the province reduced another tax we pay on gasoline (and natural gas), the excise tax, so that consumers paid only two cents in carbon price at the pumps in 2020-2021. That cost $78-million in carbon pricing revenue.

The plan is to do the same thing this year. That means that of all the revenue raised in the coming year (8.8 cents/litre and projected to be about $163-million in 2021-2022), $78-million will again subsidize oil and gas so the total we pay at the pumps is $4.21 cents/litre.

The budget speech promised to put $36-million into the Climate Action Fund and mentioned four items specifically:

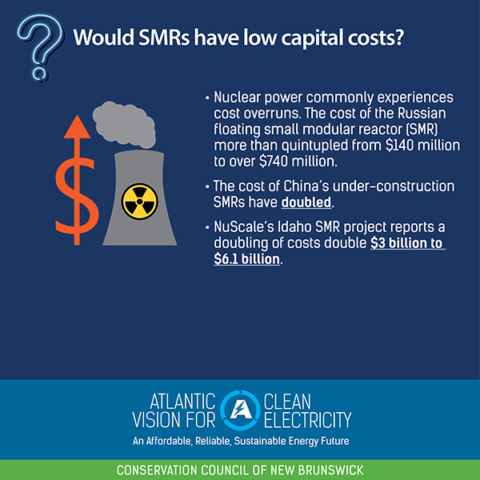

- research and development of advanced nuclear technology;

- redevelopment of Fundy Quay;

- reconstruction of the Saint Andrews wharf; and

- resources to complete 75% of actions in the New Brunswick Climate Change Action Plan by December 2021.

It appears, that like last year, there is a risk the province will continue to use most of the money in the Climate Change Fund for speculative nuclear and to pay departments to implement the climate plan; the latter being a good thing except that it appears money goes to departments to pay for activities they already pay for or should pay for. We need departments to prove spending is incremental to current spending. And we should not be using citizens’ money to fund unproven nuclear technology that delays serious climate action.

We need a better plan for next year

Last year, instead of depositing all funds raised through the carbon tax into the Climate Change Fund to invest in decarbonisation in New Brunswick, the province scooped a good portion of the money and put it into general revenue. In 2020-2021, the summary of carbon tax expenditures shows that of the $26-million spent on projects, at least $10-million of the carbon tax revenue went to general revenue to offset other government spending, essentially reducing the deficit.

The same thing could happen this year if the Climate Action Fund does not get the money out the door for real projects.

New this year, however, is $28-million not accounted for after the fossil fuel subsidies and transfer to the Climate Action Fund; money that can also go to carbon-reducing activities. Premier Higgs suggested in the March 17 question period that one option is to use this money for rebates, replicating the federal approach.

It is time to get serious about powering our province in line with the demands of a global carbon budget. There is no time like now to move from an unfair tax grab to a suite of decarbonizing investments that help citizens, businesses and industry prepare for the necessary shift away from fossil fuels.

This article was published March 18 on the NB Media Co-Op